European Business Valuation Magazine

Issue Spring 2025

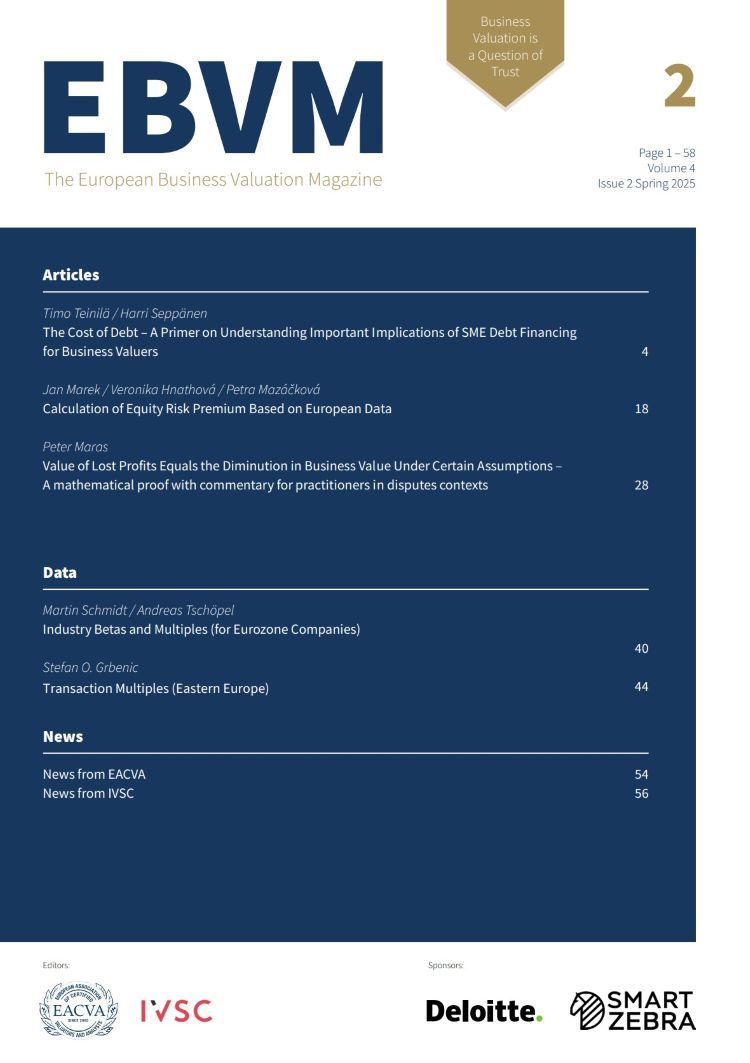

The European Association of Certified Valuators and Analysts (EACVA) and the International Valuation Standards Council (IVSC) are pleased to present the 11th issue of the new European Business Valuation Magazine (EBVM), published in June 2025.

- Editorial: People, Machines, and Added Value: The Future of Business Valuation

Andreas Creutzmann, WP/StB, CVA - The Cost of Debt – A Primer on Understanding Important Implications of SME Debt

Dr. Timo Teinilä, D.Sc. / Dr. Harri Seppänen, Ph.D., CVA - Calculation of Equity Risk Premium Based on European Data

Mgr. Jan Marek, CFA / Mgr. Veronika Hnathová / Petra Mazáčková, M.Sc. - Value of Lost Profits Equals the Diminution in Business Value Under Certain Assumptions – A mathematical proof with commentary for practitioners in disputes contexts

Peter Maras - Data: Industry Betas and Multiples (for Eurozone Companies)

Dr. Martin H. Schmidt / Dr. Andreas Tschöpel, CVA, CEFA, CIIA - Data: Transaction Multiples (Eastern Europe)

Prof. Dr. Stefan O. Grbenic, StB, CVA - News from EACVA

- News from IVSC

Abstracts

The world of business valuation is evolving. While project managers and their teams used to rely solely on experience, expertise, and analytical skills, artificial intelligence (AI) is now entering the arena.

AI can analyse data, identify correlations, and calculate scenarios much faster than humans ever could. However, it cannot replace the human ability of interpreting results, understanding context, and making informed, nuanced decisions – capabilities that remain essential for high-quality valuation outcomes.

The key question, then, is not whether AI will replace humans, but how we can best harness it to enhance our work. For project managers, this means becoming the conductor of a hybrid team of humans and machines. This expanded responsibility includes managing not just the valuation process, but also data quality, the review of AI-generated outputs, and the integration of digital tools into daily workflows.

The goal remains unchanged: delivering high-quality, persuasive expert opinions. While the path toward that goal is becoming more digital, more efficient, and more precise, its success still hinges on placing people at the center of the process.

To support you along this journey, we will continue to provide valuable insights through the European Business Valuation Magazine (EBVM), BewertungsPraktiker, and the members-only section of the EACVA website – which will soon feature a refreshed layout and enhanced functionality. Stay tuned!

In this issue, we once again present current articles from across the globe: Harri Seppänen and Timo Tenila (Finland) explore the complexities and implications of estimating the cost of debt for SMEs in business valuation. Jan Marek, Veronika Hnatova, and Petra Mazackova (Czech Republic) delve into the estimation of the equity risk premium for mid-sized companies, using European data published by the EVI. Peter Maras (Singapore) shows how, under certain assumptions, lost profits and diminution in business value can be mathematically and economically equivalent – highlighting the importance of valuation principles in selecting discount rates.

We hope you enjoy reading this issue. As always, we welcome your feedback and encourage article submissions for future issues.

This article explores the complexities and implications of estimating the cost of debt (COD) for small and medium enterprises (SMEs) in business valuation. In business valuations of SMEs, a market price for the cost of debt of a company is often not available due to the private nature of SME debt.

The article addresses the estimation of the equity risk premium for medium-sized companies outside Aaa-rated European countries, such as Czechia, Portugal, or Austria. It highlights the key challenges associated with relying on traditional data sources, particularly those derived from the U.S. market, which may result in skewed estimates. The article presents a methodology for calculating the implied equity risk premium based on current aggregated data1 from European companies. Using a bottom-up approach, this calculation eliminates the need for additional premiums for country risk and company size. Regular updates of the implied equity risk premium estimates for large and medium-sized companies are regularly published on the European Valuation Institute website (www.evalin.org).

This article challenges the conventional distinction between business valuation and lost profits quantification, despite their shared foundation in risk and valuation theory. This article demonstrates that under certain assumptions, lost profits and diminution in business value are mathematically and economically equivalent, with business valuation principles providing a robust framework for discount rate selection. By determining the discount rates of the uninjured and injured business (but for and actual scenarios), the uninjured business’s profits and lost profits, we can determine the appropriate discount rate for lost profits, reinforcing the applicability of valuation methodologies in damages quantification.

All data has been obtained from the KPMG Valuation Data Source. The data source provides access to cost of capital parameters from more than 150 countries and sectors as well as peer-group-specific data from over 16,500 companies worldwide. The data covers the period from 2012 to the present. The data is updated monthly and is accessible from anywhere around the clock. See KPMG Valuation Data Source for details.

The computations of the transaction multiples are based on the transaction and company data collected from various M&A databases, with the data being driven to consistency.

We publish transaction multiples for Europe and resulting regression parameters (including transactions of the period 1 April 2021 until 31 March 2024) for the following multiples:

- Deal Enterprise Value/Sales

- Deal Enterprise Value/EBITDA

- Deal Enterprise Value/EBIT

- Deal Enterprise Value/Invested Capital